Scalability

Limited growth due to manual processes and non integrated systems, causing bottlenecks and reaching the limit of operational capacity.

EN

With the goal of expanding its business and increasing profitability, in 2019

Guou Finance decided to automate its core business processes.

The main obstacle it faced was the outdated technology supporting its operations.

In response, the company chose to adopt BPMS technology

to automate its business processes, relying on the expertise of

Derivatik in developing digital solutions.

With over 300 million dollars in total placements,

the company ranks as the second largest factoring firm nationwide.

Guou Finance was founded in 2002. Today, it is part of one of the largest economic groups in Chile, managing over USD 200 million in assets. Guou Finance designs tailored solutions for each of its clients, serving large, medium, and small businesses.

The factoring industry like the entire financial sector faces numerous challenges: intense competition, the need to stay up to date, effective credit risk management, high interest rate volatility, strict regulatory compliance, and the pressure to advance digital transformation. This requires a high level of technological innovation to ensure that business processes are supported in a way that is coherent and consistent with the services offered.

MAIN OPPORTUNITIES

Constant errors in transaction processing, caused by the manual nature of various processes, prevented the commercial channels of Guou Finance from safely scaling transaction volumes. This blocked business growth and negatively impacted profitability.

The various activities, both human and from legacy systems, required to complete the execution of operations coming from different channels, such as the executive platform and the digital channel, to the back office systems, were coordinated and executed manually. In practice, this resulted in manual execution flows, coordinated via emails, carried out in Excel spreadsheets, and based on exceptions.

It is important to mention that Guou Finance had already gone through two software implementations with different providers, without obtaining a solution that truly supported the business. The executive and management teams were highly disappointed with the implemented solutions, which impacted team motivation.

Limited growth due to manual processes and non integrated systems, causing bottlenecks and reaching the limit of operational capacity.

Scaling operations to securely process transactions, given the manual processes and operational errors, meant increased costs beyond profitability levels.

The lack of automation in factoring approvals led to delays and reduced customer satisfaction.

Data dispersion across multiple systems increased the risk of regulatory non compliance and made traceability more difficult.

Manual processes and human errors created a high probability of incurring financial losses.

Error prone manual processes affected clients, impacting the reputation of Guou Finance.

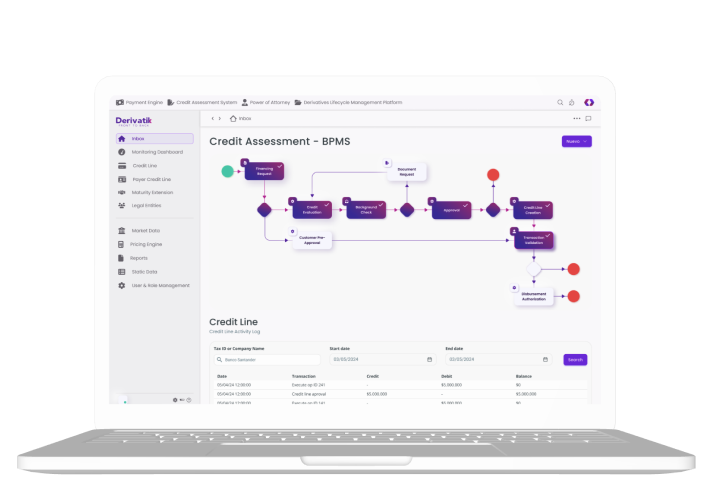

Process reengineering The first step was to form a multidisciplinary team to work in close collaboration between Guou Finance and Derivatik. An in depth assessment of the existing critical processes was carried out, identifying friction points and opportunities for improvement.

Process reengineering techniques were applied to redesign operations, eliminating non value added tasks and establishing a culture of continuous improvement.

Derivatik’s innovative approach made it possible to automate the processing of factoring transactions, a critical function that was previously slow and error prone. Automation not only accelerated processing but also reduced human errors, significantly improving accuracy and operational efficiency.

One of the most outstanding aspects of the solution was the integrated payment engine. This engine automates the disbursements made by Guou Finance to fund its clients, ensuring that payments are made securely and on time. This significantly improves the customer experience, as requested funds are received much faster than with previous manual processes.

Thanks to Derivatik’s innovative technology and a meticulous implementation, Guou Finance increased its profitability by 35%, resolved critical issues, and scaled its business efficiently. The solution transformed their operations, improved efficiency, optimized risk management, and enhanced customer satisfaction.

Today, their processes are 65% more productive, as manual tasks were eliminated and workflows were optimized significantly reducing cycle times and eliminating human errors. This led to a substantial increase in operational volume while reducing the workforce by 47%.

Contact Us for a personalized demo